Multifamily Credit Insurance Risk Transfer

Building on our long tradition of transferring risk to the private sector, MCIRT is designed to complement – and supplement – Multifamily's Delegated Underwriting and Servicing (DUS®) loss sharing program, where originating lenders share in the credit risk on our loans.

Since 2016, MCIRT has helped mitigate the remaining mortgage credit risk held by Fannie Mae by transferring a portion of the risk to diversified insurers and reinsurers counterparties.

These transactions allow us to bring a deeper, more resilient pool of capital to the Multifamily industry, increasing the liquidity, stability, and sustainability of the market.

$120.4B of unpaid principal balance was covered through MCIRT transactions, measured at the time of the transactions, as of Q4 2023.

$2.78B of coverage was provided by reinsurers through MCIRT transactions as of Q4 2023.

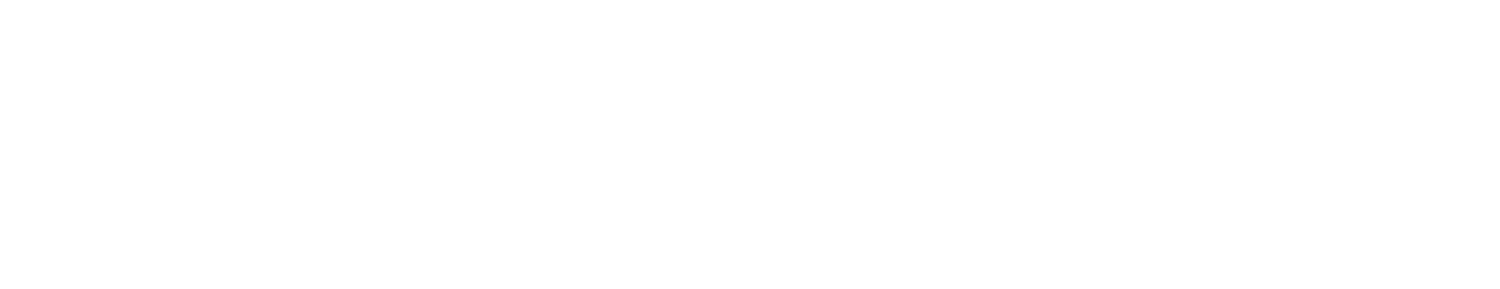

MCIRT's deal structure

Fannie Mae structures its MCIRT deal in the following manner:

Click image above for larger view

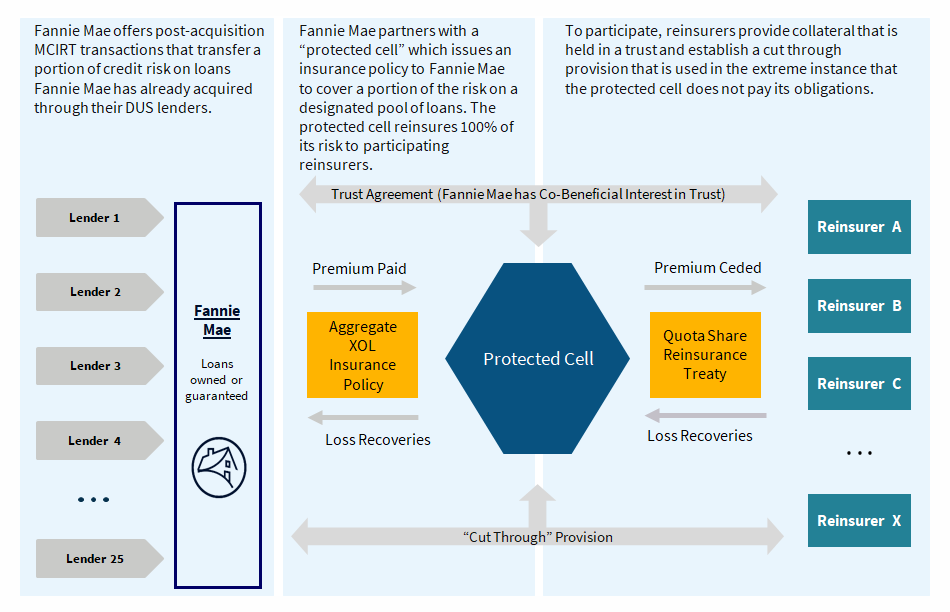

MCIRT policy structure

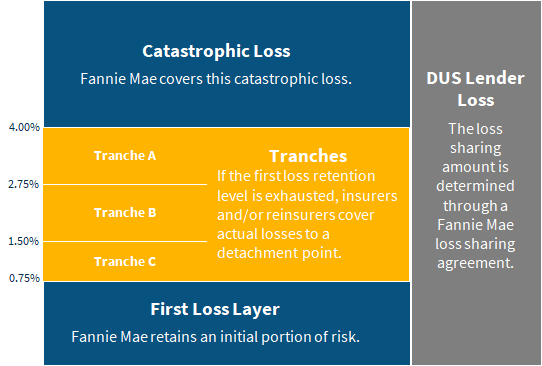

Each MCIRT transaction is structured with a retention layer and an aggregate limit of liability separated into tranches to appeal to various risk appetites. Actual loss is determined after property disposition and lender loss sharing. MCIRT transactions are typically structured as follows:

Elements of a typical MCIRT deal

Learn More

Are you a reinsurer who wants to learn more about our CIRT program? Contact us here